How to Create Mobile Banking App: Time and Cost Estimate, Ideas on How to Make it Unique

When starting your banking app development, the first thing you want to find out is its cost. The second thing you want to know is how to make your app unique and attractive to users. In this article, we reveal the cost of a mobile banking application development and give you ideas on how to make your software product stand out from the competition.

Best mobile banking apps on the market

To create a really great financial application that will stand out from the competition and meet all the needs of your target audience, you need to run the market research and check out the apps of your direct and indirect competitors, as well as the best apps that are on the market.

We’ve compared the most well-known banking app examples to find out what makes them popular and understand what best practices you can use for your app development.

Ally Bank

Ally Bank is a bank that doesn’t have any physician branches. The app offers a wide range of online services for its users. The app is so popular that it got a lot of awards. One of them is the title of the Best Online Bank for 2018 ‒ 2020, according to the MONEY Magazine.

The app lets users check banking accounts, perform money transactions, check transaction history, and find the nearest ATM. As well as this standard feature set, the app also allows users to set financial goals and track their progress in achieving them, trade stocks, and make investments via the mobile app.

One of the main reasons why users choose Ally Bank is its low commission fees compared to other banks and incredible user-friendliness of the app’s UX design.

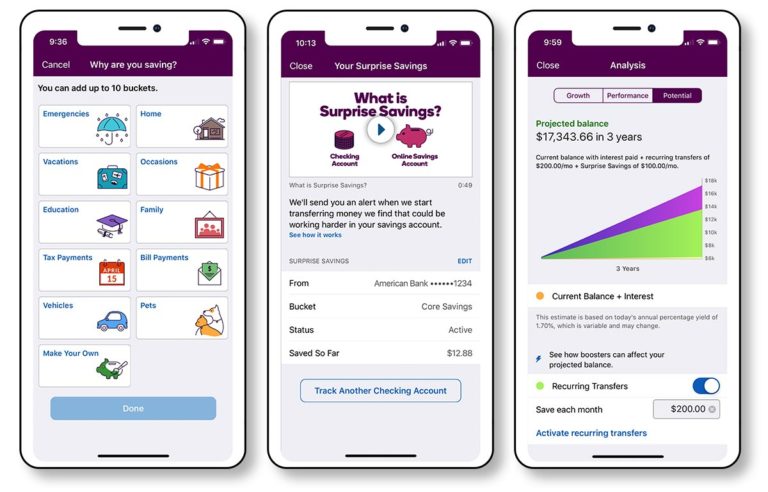

Capital One

Capital One mobile banking app is famous for its excellent customer service. Apart from the standard feature set, the app provides users with all possible tools to manage their finances, including purchase history view, notifications, banking account and loans check, etc.

To make the customer experience even better, the bank introduced Eno ‒ an AI-based assistant. Eno leverages the latest technologies to provide customers with smart personal assistance and 24/7 customer support. Eno helps users manage their accounts, reminds them to pay bills, and provides users with insights on their spending habits and more.

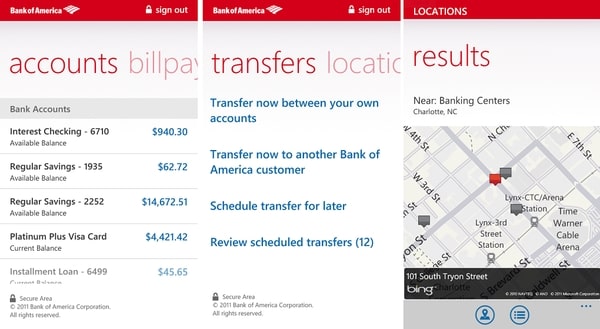

Bank of America

The Bank of America app is a great example of a highly-secure mobile application. The app is based on the latest technologies to ensure complete security and banking data protection, no matter where users are and what device they use.

The app lets users lock and unlock cards in case of loss or theft, easily change passwords and pin codes via the app, and set up security alerts and notifications.

Wrapping up

Having analyzed the best mobile banking apps on the market, we can narrow down the criteria that make a banking app genuinely great. All three apps we’ve described have some standard features. However, the developers of these products paid a great deal of attention to such characteristics as security, usability, and user-friendliness. Make sure your banking app combines these criteria and offers something new to your users.

Now, let’s find out what it takes to create a great banking app in terms of time and cost.

Read also our article on how to build a custom CRM software and details of developing a banking CRM.

Feature set for your banking app with time estimation

The amount of resources needed to develop a banking app depends on several factors. However, the main factors are the features you need in the app and the hourly rate of a vendor you’re going to hire for the job. We’ll start with the features.

Your banking app development can easily go off the road. The scope can creep, breaking the deadlines, and disrupting the budget. To avoid this, create a feature set for your banking app's minimum viable product ‒ your app's first release. The MVP development approach allows you to define and prioritize features that will form the core of your future product. Below is the list of essential features for a banking app and the time needed to implement them.

Secure authorization

Security is one of the most important aspects to think through in your banking app. A simple password isn’t enough nowadays. Here are the ideas on how you can make authorization in your app more secure.

- Biometrics. Biometrical data like fingerprint and face scan allow you to make your app more secure. Nevertheless, this authentication method can’t be the only one in your app. It has to be enhanced with additional authentication steps.

- One time passwords are sent to users’ phone numbers to confirm users’ identity. This approach will be more convenient for users if OTP is automatically inputted in a special field.

- Risk-based authentication is a more sophisticated approach that requires massive analytics in your system. The analytical system tracks such data as password input time, a number of attempts, location of a user, and other data to assess the possibility of a hack. In case the system identifies a thread, it asks a user for an additional identification step.

- Limited session time allows users to stay authorized for a certain time. If the session time has passed, users need to authorize again.

- Outdating passwords. Engage users to change their passwords regularly to prevent money thefts.

Time estimation. The development of the secure authorization in your banking app using biometrics and OTP can take up to 40 hours in case the company you entrust your product development creates everything from scratch. If you choose a company with an in-depth experience in the banking domain, like BUT, that has some groundworks, the development of this feature can be reduced to 20 hours.

Personal account

This set of features allows users to set up purchase limits, lock and unlock cards, change personal settings, change pins or passwords, etc.

Time estimation. The development of the personal account in your banking app takes 20 hours from scratch and 10 hours using the company's groundworks.

Account management

The account management section lets users add or remove accounts, view balance, transaction history, and see their income and spendings analytics.

Time estimation. The development of the account management feature set in your banking application from scratch takes 100 hours and 40 hours using groundworks.

Transactions

Allow your customers to send and receive money to and from other accounts quickly. If users need to input card or account number manually, minimize the chance of a typo using masking and placeholders in the input fields.

Time estimation. The development of the transaction feature set in your banking application from scratch takes 80 hours, and 40 hours using groundworks

Notifications

Notifications serve a lot of purposes in a banking app. They can remind users to make a regular payment or pay the bills. They can also inform customers about automatic money transfers. Notifications increase the security of your app, allowing users to have better control over their money. Nevertheless, too many notifications annoy users.That's why you should allow users to easily set up notification preferences so they can choose the types of notifications they want to get.

Time estimation. The development of the notification feature in your banking application from scratch takes 90 hours and 40 hours with groundworks.

Brunch and ATM location

This feature shows a customer's location on the map and the nearest ATM or your bank branch. Users should always be able to find where to withdraw money in case of necessity.

Time estimation. The development of this feature from scratch takes 80 hours and 40 hours if using groundworks.

Customer support

No matter if it’s a chatbot or a human operator, customers should be able to easily get help from any place in your app. Make the support chat button visible, so users know how to ask for assistance.

Time estimation. The development of the customer support feature set in your banking application takes 20 hours.

Wrapping up

If you start the development of your banking app with the features we’ve listed above and choose the development from scratch, your development team will need 430 hours to create it. If you opt to work with an experienced team that has a lot of knowledge and groundworks, the development of the app will take you 210 hours.

It’s also worth mentioning that the design is an integral part of your app development. The time required to create a design of your app can take from a month to a year depending on the chosen style, complexity, layouts, and many other factors. The basic design of a bank app with the mentioned features will take about 100 hours.

Now, let’s find out your banking app development cost.

Banking application cost

To calculate the cost of banking app development, you need to know the hourly rate of the team you’re going to hire. The hourly rate depends on the experience of the team, its size, maturity, and location. The hourly rates of the development teams can vary from $15 to $200 per hour. Let’s have a look.

| Country or region | USA | Eastern Europe | India |

| Hourly rate in USD | 150 - 200 | 25 - 75 | 15 - 25 |

To find out the cost of mobile banking app development, you need to multiply the total estimate in hours by the hourly rate of the team you hire.

For instance, the development from scratch with design in the US will cost you about $92 750. If you hire a team from the Eastern European country, the development from scratch will cost you $26 500, and the development in India will cost you $10 600.

In case you choose to create your banking app using a company with groundworks, the average cost for the development with design in the US will be $54 250, in Eastern European countries the sum is $15 500, and $6 200 for companies in India.

This is the approximate estimate that demonstrates the average time required to create similar apps. The numbers vary depending on the project requirements, feature list, and chosen design.

BUT has vast experience in Banking software development and mobile banking development.Contact our team if you want to get a free time and money estimate for your product and the team roster required to implement your product in life

Parting thought

When looking for a development team to create your banking app, don’t use a low hourly price as the main selection standard. The team with a low hourly rate can appear inexperienced and immature. Look for the team that is the best price-quality ratio with extensive experience in the financial industry. Such a team will not only deliver you your banking product on time and within your budget, but also add value to your software using their groundworks and knowledge in the domain.

In a trustworthy technology partner to develop your banking app? Drop us a line, and let’s get it started!