Payment Gateway Integration in Mobile Application

A payment gateway is a technology that enables merchants to accept electronic payments from customers through their mobile applications. It is a secure bridge between the merchant's website or mobile application and the financial institutions that process the transactions.

Mobile app payment integration allows merchants to expand their customer base by offering a convenient and secure way for customers to make payments on the go.

In this article, we will delve into integrating a payment gateway in a mobile application, its benefits to merchants, and the considerations to keep in mind while choosing a payment gateway for your mobile application.

What is a Payment Gateway for Mobile Apps?

A mobile payment gateway is a technology that enables secure online payments from a mobile device, such as a smartphone or tablet. It allows users to make payments using their mobile devices by entering their credit card information directly into an app or a mobile wallet, such as Apple Pay or Google Pay.

The mobile payment gateway handles the secure transmission of payment information from the mobile device to the merchant's payment processor, ensuring that the transaction is completed safely and securely. This is typically accomplished through encryption and other security measures to protect the payment information transmitted over the internet.

To use a mobile payment gateway, merchants must integrate it into their website or mobile app. This is typically done through an API, which allows the mobile app or website to communicate with the payment gateway and process transactions.

There are several benefits to using a mobile payment gateway. For consumers, it provides a convenient and secure way to make payments on the go. For merchants, it can increase sales and reduce the risk of fraud by providing a safe method for accepting payments.

Overall, a mobile payment gateway is a valuable tool for enabling secure online payments from a mobile device and can be integrated into a mobile app or website to provide users with a convenient and safe way to make payments.

What to Consider when Choosing a Payment Gateway

When choosing a payment gateway for your mobile application, there are key considerations to keep in mind:

- Compatibility

Choosing a payment gateway compatible with your mobile application platform and having a robust API for seamless integration is essential.

- Cost

Consider the charges associated with the payment gateway, as these can vary significantly. It is also a good idea to choose a payment gateway that offers a range of payment methods to cater to the diverse needs of your customers.

- Support

Finally, consider the level of support and resources the payment gateway provides, as you may need assistance with technical issues or other queries during the integration process.

What does Payment Gateway Integration Cost?

The cost of a payment gateway integration in the mobile application can vary depending on the provider and your specific plan. Some payment gateway providers charge a monthly or annual fee, while others charge a per-transaction fee. Some payment gateway providers may charge additional fees for specific features or services, such as PCI compliance or fraud protection.

Generally, you can pay a per-transaction fee ranging from around 0.10% to 3% of the transaction, plus a fixed fee of about $0.30 to $0.50. Some payment gateway providers may offer discounted rates for higher volume merchants or specific types of transactions.

It's important to carefully review the pricing and terms of any payment gateway you're considering to ensure that it meets your needs and budget. You may also want to shop around and compare prices from multiple payment gateway providers to find the best deal. Remember that lower cost doesn't necessarily mean the best deal. You must ensure you're paying for the best payment gateway software development that guarantees premium customer experience and security.

Credit Card Payment Integration

Credit card payment integration in mobile apps allows users to make purchases or pay for services using their credit cards directly from their mobile devices. This can be particularly useful for e-commerce apps, where users can make purchases without entering their credit card information each time.

To integrate credit card payments into a mobile app, developers can use a payment gateway or third-party payment processor. They will also need to ensure that the app is secure and compliant with relevant regulations, such as PCI DSS, a vital requirement for secure fintech software.

In addition to offering convenience for users, credit card payment integration can also help businesses increase sales by making it easier for customers to complete transactions. It is essential to carefully consider the chosen integration method and thoroughly test the payment system to ensure a smooth and secure user experience.

Features and Benefits of Mobile Payment Gateways

Mobile payment gateways offer a range of features and benefits for businesses and consumers, including:

- Security

Mobile payment gateways use secure servers and encryption to protect sensitive customer data and prevent fraud. They also often offer fraud prevention tools to help businesses detect and prevent fraudulent transactions.

- Convenience

Convenience is an essential part of the digital banking revolution. Mobile payment gateways allow customers to make purchases from their mobile devices, making it easy and convenient for them to shop on the go without having to visit the bank to make cash withdrawals. This is particularly useful for businesses that sell physical goods, as it allows customers to make purchases anytime, anywhere.

- Multiple Payment Methods

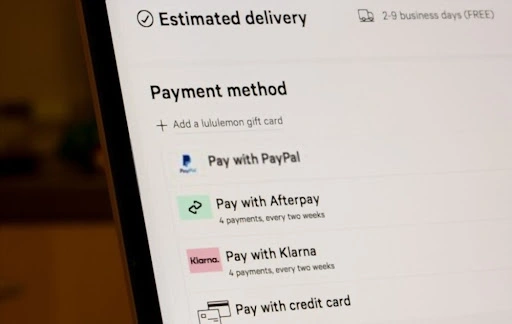

Mobile payment gateways support a range of payment methods, including credit and debit cards, as well as alternative payment methods like PayPal and Apple Pay. This allows businesses to accept payments from customers regardless of the payment method they prefer.

- Global Reach

Mobile payment gateways can process transactions in multiple currencies, allowing businesses to sell to customers worldwide. This is particularly useful for companies operating in numerous countries or expanding into new markets.

- Customization

Many mobile payment gateways offer customizable options, allowing businesses to tailor their payment experience to meet the needs of their customers. For example, companies can display specific payment methods or add branding to the payment process.

- Scalability

Mobile payment gateways can handle a large volume of transactions, making it easy for businesses to scale their operations as they grow. This is particularly useful for companies that experience spikes in demand, such as during the holiday season.

- Integration

Mobile payment gateways can be easily integrated into mobile apps and websites, making it easy for businesses to accept customer payments. This can be done by using APIs, which allow the business's systems to communicate with the payment gateway and process transactions on behalf of the customer.

In addition to these features, mobile payment gateways often offer additional services, such as customer support, dispute resolution, and the ability to process recurring payments. Overall, mobile payment gateways offer a range of benefits for businesses looking to accept payments from customers via mobile apps and websites.

How Mobile Payment Gateways Work

Here's how a payment gateway works when integrated with an app:

- The user initiates a payment by entering their payment information (e.g., credit card number, expiration date, and security code) into the mobile app.

- The mobile app sends the payment information to the payment gateway, which acts as an intermediary between the mobile app and the payment processor.

- The payment gateway encrypts the payment information and sends it to the payment processor for authorization.

- The payment processor verifies the payment information with the user's bank or financial institution and returns a response to the payment gateway indicating whether the payment was approved or declined.

- The payment gateway receives the response from the payment processor and sends it back to the mobile app.

- If the payment is approved, the mobile app updates the user's account and displays a confirmation message to the user. If the payment is declined, the mobile app displays an error message to the user.

It's important to note that each payment gateway may have specific processes and requirements, so the exact steps may vary slightly depending on the payment gateway in use.

How to Integrate Mobile Payment Gateways in Mobile Apps

Though the coding may differ significantly, the essential step-by-step integration of merchant-in-app payment gateways for iOS, Android, and hybrid apps is the same.

Mobile Payment Gateway Integration for iOS Apps

To implement payment integration in iOS apps, you will need to follow these steps:

- First, you must sign up for a payment gateway service and obtain the necessary credentials, such as a merchant ID and API keys. Some popular payment gateway solutions include Stripe, PayPal, and Braintree.

- Next, you install the payment gateway's SDK in your iOS app. This typically involves adding the SDK to your project's dependencies and importing the necessary frameworks.

- Once the SDK is installed, you will configure it with your merchant credentials and other necessary settings. This may involve creating a configuration object and passing it to the SDK.

- Next, you will need to implement the payment flow in your app. This typically involves creating a payment form for users to enter their payment details and then using the payment gateway's SDK to initiate the payment.

- Finally, you will need to handle the response from the payment gateway, including any errors that may occur during the payment process. This may involve displaying an error message to the user or updating the app's internal state to reflect the payment status.

Overall, integrating a payment gateway for an iOS app involves installing and configuring the payment gateway's SDK, implementing the payment flow in your app, and handling the response from the payment gateway.

Mobile Payment Gateway Integration for Android Apps

To implement a credit card payment Android app gateway, you will need to follow these steps:

- Choose a payment gateway provider: Various payment gateway providers are available in the market. Choose a provider that meets your requirements and is compatible with your app.

- Sign up for an account: Once you have chosen a payment gateway provider, sign up with them. You will typically need to provide your business details and complete the KYC process.

- Integrate the payment gateway SDK: The payment gateway provider will provide an SDK that you can use to integrate the payment gateway into your app. The SDK will include libraries, documentation, and sample code to help you get started.

- Implement the payment flow: Once you have integrated the payment gateway SDK into your app, you will need to implement the payment flow. This involves adding buttons or forms to your app that allow users to initiate a payment and handle the payment process and any responses from the payment gateway.

- Test and deploy: Before launching your app, it is important to thoroughly test the payment gateway integration to ensure it is working correctly. This may involve setting up test accounts and making test transactions to ensure everything functions as expected. Once you have tested the payment flow, you can deploy your app and start accepting user payments.

Adding a payment gateway to an Android app involves integrating the payment gateway SDK, implementing the payment flow, and testing and deploying the app. Following these steps, you can easily accept user payments through your Android app.

Mobile Payment Gateway for Hybrid Apps

To set up a payment gateway for a hybrid app (an app that combines elements of native and web-based apps), you will need to follow these steps:

- Choose a provider: Many options exist, and each has benefits and costs. Stripe, PayPal, and Square are examples that come to mind.

- Register an account: Account creation is the next step after deciding on a payment gateway service. Typical steps include filling out a form with your personal and company details and choosing a payment option (such as a bank account or credit card).

- Integrate the gateway into your app: In most cases, the payment gateway company will also supply instructions detailing how to incorporate their service into your app. You may need to add billing functionality to your app by installing a plugin or SDK.

- Test the payment gateway: Testing the payment gateway before releasing your app to the public is crucial. The payment gateway provider will provide fake credit card numbers for testing purposes.

- Go live: If everything checks out during testing, you may release your app to the public and begin receiving money from paying users.

Setting up a payment gateway for a hybrid app may require some technical expertise, so you may need to enlist the help of expert developers if you are not comfortable coding.

Hire a Mobile App Developer

Payment gateways are essential for businesses that want to accept payments online, including through mobile apps. Setting up a payment gateway for a mobile app involves choosing a payment gateway provider, signing up for an account, integrating the payment gateway into the app, and testing the payment gateway before going live.

There are many payment gateway providers to choose from, each with its features and fees, so it is essential to research and find the one that best meets your needs. Payment gateways can help businesses of all sizes to accept payments securely and efficiently, making them an essential tool for any business with a mobile app.

At Boston-UniSoft, we help businesses to improve their app's customer experience by redefining mobile payment gateway integration. Our team of mobile app developers has vast experience in the financial app industry. Contact us to discuss your project.