Top 4 Mobile Banking Trends To Watch In 2022

Mobile banking is a trend that emerged very quickly. With its short history, it’s now ubiquitously used in people’s mobile devices. 86.5% of Americans used a mobile device to view their banking information in 2020. In the same year, mobile devices were used to make payments worth a total of over $503 billion.

The future of mobile banking is both exciting and complex. Mobile banking trends have increasingly been tied in with the latest trends in fintech. This recurring theme will likely continue.

But for now, let’s jump right into the most important trends in mobile banking for 2022.

Use Of Blockchain In The FinTech Industry

Blockchain in fintech has already shown case studies where blockchain can provide the industry with greater efficiency. As an alternative to traditional banking, blockchain and fintech provide a new level of decentralization and equity.

Specific use cases for blockchain in fintech that offer the most promise include:

- The faster transfer of funds between individuals and between institutions

- More modern security that is now considered top-of-the-line

- A transparent way to monitor transactions, while balancing transactional transparency with individual privacy

Being alternatives to the traditional services offered by financial institutions, these trends could have the furthest reach.

- Scalability

- Security

- Adaptability

On the third note, blockchain and fintech solutions are normally unique to the business they are applied to. It’s pretty difficult for most small businesses to apply blockchain solutions without outside assistance. However, the benefits normally outweigh the costs:

- Digital ledgers which transparently and automatically time-stamp transactions

- Decentralized networks lacking single points of control, or of failure, offering protection from fraud and cyber crimes

- Unless an attacker controls more than half of a given blockchain, successful attacks are extremely rare

- The removal of traditional third-party intermediaries from transactions (multi-step validation, processing, etc.)

- Decentralization and democratization of the storage and management of money, as blockchain removes the need for banking intermediaries as well

NFT Meaning In Crypto

NFTs have taken the DeFi world by storm. Acting as a bridge between decentralized finance and the (mostly) digital art world, NFT trends are worth monitoring for both art and finance professionals.

NFT: What Does It Stand For?

The NFT abbreviation stands for “Non-fungible token”. The “token” is self-explanatory, but “non-fungible” leaves most people no less confused about what they’re reading about.

What Is An NFT And How Does It Work?

Non-fungible means that something is unique and not replicable. Currencies, fiat or crypto, are fungible because they are not unique, if you give one of your Bitcoins or Dollars for another Bitcoin or Dollar, you have the exact same thing with the exact same value.

Non-fungible items are unique and aren’t interchangeable with other items. Some sports cards and other collectibles are non-fungible for this reason. Their prices vary, they are unique.

The NFT marketplace is a marketplace of tokens that provide proof of ownership over pieces of digital art. The scope of the NFT marketplace is huge. It can include:

- Graphics and images

- Videos

- GIFs

- Music/audio files

- A human brain downloaded and transformed into AI

- An interesting Tweet

- Much more

That’s right, you can buy digital ownership of a Tweet.

The point here is that NFTs have quickly become incredibly popular (and often valuable) as a means of exchange over digital art ownership.

NFT Market Trends

The NFT market is young but highly modernized. So, we have a lot of accurate NFT market data to use in assessing the current and future states of the market.

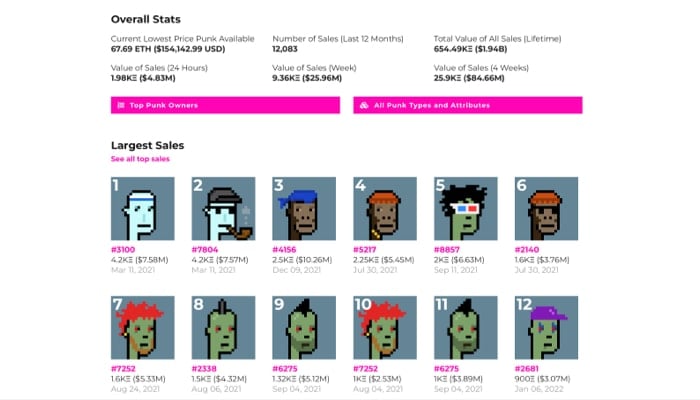

The size of the NFT market, as measured by total sales to date (beginning of December 2021), is $7 billion. Tens of thousands of NFTs are sold every week. According to nonfungible.com, October 5th, 2021 was the busiest date so far with 391,526 NFT sales during those 24 hours.

Usage of NFT wallets has fluctuated more. At its absolute height of popularity so far, the NFT market included over 139,000 active wallets. While that number has gone down, the active wallets that remain more often belong to dedicated members of a global NFT community.

NFT sales are not low-value exchanges, for the most part. The average NFT has sold for no less than $150 during 2021, with that figure normally resting between $1,000 and $5,000 for the latter half of 2021. There were also already dozens of NFT brokers active online during the same time.

What Is An Example Of An NFT?

We’ve gone over the forms an NFT can take.

Here is perhaps the most relevant (read: highest-priced) NFT to use as an example. Everydays: The First 5,000 Days sold for $69.3 million.

The CryptoPunk series covers 5 of the top 10 priced NFTs.

How Does NFT Affect The Banking Industry?

NFT use cases typically involve art creators and collectors. But as NFT company funding rose 6,427% during Q3 of 2021, financial institutions have taken notice.

NFTs have primarily remained in the realm of decentralized finance, where they may play a pivotal role. Decentralized finance is the home of cutting-edge fintech projects that are actively disrupting intermediaries in the financial industries. They primarily do this by improving the efficiency of financial processes and removing the need for many traditional intermediaries.

NFTs have primarily remained in the realm of decentralized finance, where they may play a pivotal role. Decentralized finance is the home of cutting-edge fintech projects that are actively disrupting intermediaries in the financial industries. They primarily do this by improving the efficiency of financial processes and removing the need for many traditional intermediaries.

The processes which NFTs are disrupting have so far been relegated to the art world. The dynamics brought forward remove the need for traditional intermediaries in art, such as dealers and galleries. These long-established intermediaries, at least in segments of the art world, are being replaced with blockchain solutions. This promotes transparency and fairness, which have often not been present in the art world.

Are NFTs The Future?

NFTs as an asset class are already sparking interest in the financial industries. NFT market trends spark this interest because of the hype surrounding NFTs, which happen to represent So far, there have only been a few notable NFT use cases. One of them came up during the June 2021 global NFT summit in Guangzhou. There, one speaker introduced the application of NFTs in the renewable energy market.

In August 2021, EV Biologics became the first company to pay the “NFT dividend”. Their stock dividend was paid out in the form of an NFT.

Central Bank Digital Currency And The Future Of Monetary Policy

The gold standard was dropped in the US in 1933. The term “Central Bank digital currency” (CBDC) refers to fiat currencies as electronic records of a nation’s currency. That means that while they are essentially digital assets, they are fully backed by the issuing government.

Developments in the cryptocurrency market have provided a view of what an alternative (decentralized) currency system looks like. Stringent regulation is not necessary to make such a system work. Transfers can be made without anything physically changing hands. Transparency and ethics can be enforced without the force of a government.

As of yet, no central banks back Bitcoin or other cryptos in earnest. However, many governments, including those of some of the worlds’ largest economies, have flirted with the idea or are actively engaging in small-scale implementation. Russia’s CryptoRuble, for example, was announced in 2017. During the same year, Swedish Riksbank began exploring how rolling out a national digital currency would work. Central banks have since started exploring these ideas in:

- The UK

- Canada

- Uruguay

- Thailand

- Singapore

- Venezuela

In addition, China, long one of the harshest governments on cryptocurrency regulation, has already launched a pilot project for a national Digital Yuan.

Central Bank digital currencies aren’t going to emerge everywhere, but 2022 will see these initiatives expanded upon. As late as Q4 of 2021, governments of the wealthiest economies have been considering new applications for CBDCs. Projects like the EU’s Digital Euro project or the British UK CBDC are in the books for completion during 2022 or shortly after.

The development and advancement of CBDCs is one of the main mobile banking trends to look forward to in 2022.

VR And AR In Banking Industry

Virtual reality (VR) and augmented reality (AR) are overarching trends that will permeate most of society moving forward. The momentum has already been well-established in 2022 as many industries begin adopting them for various applications.

The banking industry has not been left out of the VR/AR revolution.

VR and AR in banking enable banks (and other financial institutions) to establish virtual bank branches. Specifically, augmented reality banking will improve the delivery and accessibility of banking. An augmented reality bank can be used for day-to-day banking services. More importantly, it can be used for engaging customers with:

- More personalized attention

- A more comprehensive experience

- Faster delivery of services to more customers

- A 360-degree view displaying all necessary information

Administration and payments will increasingly move into a virtual/augmented space. Contactless bank cards and virtual/digital wallets will be more accepted. This solves a few challenges, improving security. Physical theft in a virtual space is impossible. With modern authentication and other cybersecurity processes, it can also be safer from cybercrime.

What AR/VR ultimately offers is a bridge between the impersonal and often-tiresome world of online banking and the also-often-tiresome world of in-person branch banking. As a somewhat self-serving application, it reduces the need for in-person support

Administration With AR Financial Services

Technology is increasingly used to promote efficiency. More is done at a lower cost. This is exactly what AR and VR banking are meant for.

Reviewing and filling out documents over AR/VR will increase efficiency. During the same time, customers can chat with bank staff inside their AR/VR. This form of banking is truly mobile; many services can be delivered without the need for in-person service at a real branch.

Going forward, you can expect more applications of mobile banking to be explored and developed in AR/VR.

Is It The Right Time To Enter The Market With Your Own Mobile Banking App?

The short answer is a resounding “YES!”.

Creating a mobile banking app has never been easier. Mobile banking solutions are convenient and flexible. With all of the trends we’ve discussed in mind, people actually expect financial institutions to offer these solutions.

Consumer expectations are high in the competitive marketplace of mobile banking. However, the resources at your disposal are numerous. Your business may or may not have the staff and infrastructure needed to create and manage an app. But you can always outsource some of the work and seek out broader solutions.

Overall, the process of creating a mobile app for banking requires:

- Research and planning (requires the full range of professionals)

- Developing a prototype (dev team)

- Security (cybersecurity professionals)

- UI and UX (UI and UX designers)

- Tech stack (devs)

- Code

- Necessary third-party integrations

- Marketing (marketing team)

- Long-term management (all of the above)

- Possibly more, depending on your unique requirements

A lot goes into making a quality mobile banking app. That’s why there are so many different professionals involved. This all isn’t meant to overlook the need for professionals who understand the latest trends in mobile banking and can point your teams in the right direction for your mobile banking app.

While this all may sound intimidating at first (depending on the size and maturity of your business), there are solutions available to efficiently fill in any gaps your business has in producing an app.

Banks around the world have already started experimenting. A quick “VR bank” search on Google will reveal the list of banks in different countries that have already implemented aspects of VR banking. Virtual assistance is one of the more widely embraced developments.

What Can Boston Unisoft Offer You?

As you’ve now seen, creating a mobile banking app is complicated. But not having the experience and staff you need is completely normal and fine.

Boston Unisoft consists of experienced developers with extensive expertise in the fintech space. We also offer outsourcing partnership options.

Regardless of whether you want to develop a mobile banking app, invest in NFT technology, or simply discuss your options, reach out now to have a discussion about your first steps. If you’re unsure of where your business stands, we can also discuss and estimate the digitalization of your business.

Boston Unisoft prides itself on our excellent and professional service for competitive pricing. We are here and ready to discuss any of your digitalization needs.