How Credit Scoring Software Solutions Help Assess Creditworthiness

The first thing that comes to every lender's mind when receiving a loan or credit application is to assess the risk of parting with their money. It doesn't matter if you are a veteran at lending. No one gets used to taking risks. For that reason, banks and other financial service providers conduct detailed analyses of the risk involved before we give out money to the borrower.

Meanwhile, knowing the nature of borrowing and the discomfort it causes lenders, borrowers have to assess themselves too in the light of the amount they want to borrow. Thus, the topic of credit scoring and creditworthiness springs forth, since a borrower can be worthy of a particular loan amount but not so deserving of a higher amount.

In this article, we will discuss how credit scoring software solutions help solve the bottlenecks of traditional credit scoring systems. We will look further into the benefits of credit scoring software for financial institutions and loan applicants.

Traditional Credit Scoring

Generally, the result of every credit scoring determines if the lender would release the loan to the borrower or not. For that reason, lenders prefer clients with robust loan files and repayment histories. The availability of historical data provides proof to back the borrower's credibility claim. It naturally earns the borrower a good credit score. Borrowers with high credit scores will most likely have their loan requests sanctioned. In addition to that, they also stand better chances of getting lower interest rates.

From the above, you will understand that not having a thick credit file doesn't automatically disqualify you from obtaining credits. In the banking or finance industry, possessing only a scanty loan history makes the lender see you as a riskier borrower. For that reason, you may only qualify for smaller loan amounts or high-interest rates based on your credit score.

However, you may wonder if people with no credit history cannot qualify for loans with the conventional credit scoring process. That is practically impossible, since every borrower once had no loan history. Over the years, the credit scoring process has grown from the traditional approach to a digital transformation of the banking industry with innovations like alternative credit scoring. All these measures keep improving to ensure that lenders operate within the boundaries of reasonable risk by granting borrowers the credit amounts for which they have been scored worthy.

Like a romantic relationship, borrowing is a two-way street that requires the lender to be diligently objective, and the borrower to possess the integrity necessary for repayment. So, while determining the borrower's creditworthiness is the central focus of every credit grant, both parties have an obligation once the loan is given. The degree of a borrower's integrity (whether high or low) determines if he is worthy of the loan or not.

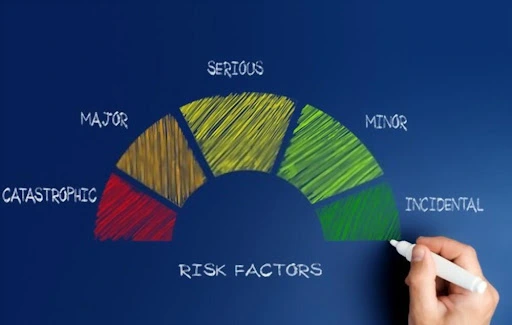

However, unlike romantic relationships, creditworthiness is not measured by the borrower's word of mouth, and lenders do not grant loans based on the benefit of doubts. The concept of credit scoring tries to measure the borrower's creditworthiness to determine the extent of risk the lender has to brace. In other words, credit scoring is an objective process that lenders use to measure borrowers' creditworthiness.

What Is Credit Scoring Software?

Credit scoring software implementation uses technology to determine or assess the creditworthiness of loan applicants. The underlining word that distinguishes credit scoring software from traditional credit scoring systems is the use of technology.

Therefore, credit scoring software is a product of progressive fintech companies who have realized that credit scores generated through the traditional system have limitations. These limitations make borrowing unnecessarily strict for financial institutions and borrowers, which negatively affects the digital banking industry and its growth. The traditional approach is rigid and quickly disqualifies even potentially credible borrowers due to its overreliance on the applicant's credit history.

The innovation of credit scoring software came from the fantastic attempt by fintech companies to smoothen the rough edges of how traditional credit assessment functions. As noted earlier in the introduction, a credIt scoring approach that assumes that individuals and SMEs with little or no credit history are ineligible for loans is not entirely functional.

Credit scoring software tries to accommodate a system that allows lenders to assess the creditworthiness of individuals and small businesses that do not yet have a thick credit file. This improved technological assessment system is beneficial to lenders as it allows them to access a wider demography of borrowers. It is also a massive relief for borrowers who ordinarily wouldn't have qualified for credits when assessed with the traditional tools.

In addition to its flexibility, credit scoring software also helps borrowers access lower interest rates than they ordinarily would have been offered under traditional tools. This advantage stems from the fact that credit scoring software leverages other data about borrowers, apart from their credit history, to assess their loan applications and determine if they are creditworthy.

However, like every technological leap, different fintech companies develop credit scoring software with unique features. While some are better than others, we believe that the availability of options is always better than the restrictions that come with one. These software options are all functional, with the main differentiating factors coming from the lending institutions' unique operating styles.

So, instead of implementing a limited generic template, credit scoring software offers you the opportunity to adapt or develop a scoring system that best serves your niche and operation. The traditional credit scoring system was much more brittle and less adaptable, as you will see when we discuss why the system no longer works later in this article.

If served well, financial institutions can dig deeper into the potential of the underbanked population and improve the GDP of their country while beating their ROI expectations.

What Is Alternative Credit Scoring?

Alternative credit scoring is often confused to mean something different from credit scoring software. The two are one and almost the same thing. The slight difference is that while alternative credit scoring is the broad concept of determining credit worthiness, credit scoring software is a particular example of an alternative credit scoring solution.

Historically, alternative credit scoring originated with the growth and proliferation of fintech in the 1990s. Before the emergence of alternative credit scoring, lenders had to rely on credit information about particular lenders at the credit bureau. So, you can imagine how difficult it must have been to access a loan if you have no record or history as a credible debtor.

Students, retirees, startups, etc., were the individuals and organizations most hit by this credit scoring rigidity. The alternative credit scoring idea recognizes that the lack of or insufficient credit data should not automatically disqualify applicants accessing credit. Fintech companies took up this challenge, and credit scoring software is the best solution they have developed.

Financial institutions and banks are leveraging the alternative credit scoring system to measure if loan applicants are creditworthy based on other considerations and their digital footprints. The alternative credit scoring system is more reliable than the traditional system. It uses current, relatable, and holistic lifestyle data to define applicants' creditworthiness other than their credit history.

The alternative credit scoring system helps the lender see a more realistic picture of the risk involved with every loan applicant. It also allows the applicant to access their first loans to start their journeys to build a more solid credit score.

You may be wondering which data alternative credit scoring systems use to determine if an applicant is creditworthy. Aside from the credit history, alternative credit scoring systems seek data that proves if a borrower is:

- Able to pay

- Stable

- Willing to pay.

The good thing about traditional credit history is that it more readily offers the above information about any applicant. But as we have established, many borrowers can still be eligible for loans at fair interest rates even without having a credit history.

So, an alternative credit scoring system uses the social and digital data of the applicant to determine is effectively able to pay back the amount he is requesting. Also, it determines if the borrower has enough financial stability and willingness to pay back. In other words, financial institutions use the alternative credit scoring technology to assess borrowers based on recent data that reflect more of who they are and what makes them creditworthy.

To determine if an applicant is able, stable, and willing to pay back loans, alternative credit scoring uses data regarding their:

- Bank account details in recent time

- Current rental and lease status

- Utility and phone bills payments.

The beauty of the alternative credit scoring technology is that it shows you the current risk level of every borrower, unlike the traditional system that relies on history that may be irrelevant at the time of the new loan application. The alternative credit scoring report also shows the financial discipline of the applicant beyond mere scores. This discipline, especially with the payment of utility bills, tells if the applicant would be willing to pay back the loan.

Also, the social data of the applicant go a long way to show the behavioral patterns that might signal if he's a high-risk or low-risk borrower. Using social data in alternative credit scoring is gaining wide acceptance in the US. However, financial institutions are still trying to find better ways to balance it and the conflicting anti-discrimination laws.

In the end, lenders' priority is to ensure the safety of their funds and the accruing interest, and they will always favor a credit scoring tool that delivers the most reliable information.

Why Traditional Credit Scoring No Longer Works

In the traditional credit scoring system, financial institutions determine if loan applicants are creditworthy by assessing their credit history for payment history, current debts, credit utilization ratio, etc.

The nature of the traditional credit scoring system automatically disqualifies the majority of borrowers, especially in developing countries where many people do not have impressive records of the yardsticks above. In addition to disqualifying many applicants, the system is highly predictable since it is based on data from central credit bureaus.

The information contained in public bureaus cannot always be the complete details about borrowers, and to base the judgment of their creditworthiness on such data is unrealistic. In addition, this World Bank publication has expressed the question of the credibility of the public bureau data in developing countries.

Given these circumstances, traditional credit scoring may have a good premise. Still, it has functional flaws that can mislead financial institutions to grant credits to the unworthy and deny worthy applicants loans.

Therefore, the alternative credit scoring came with benefits which are improvements on the weaknesses of the traditional system.

Credit Scoring Software Benefits

Credit scoring software is the latest innovation for alternative credit scoring by fintech companies. The technology has improved the weaknesses of the traditional credit scoring system in the following ways:

- Wider Customer Base

The credit scoring software allows the banks and other financial service providers to assess the creditworthiness of applicants who have little or no credit history more realistically. Credit scoring software opens the door for financial institutions to consider other assessment yardsticks aside from credit history.

- Improved Customer Engagement And Experience

Unlike the highly predictive traditional system, credit scoring software offers applicants the satisfaction of being considered personally based on their present circumstances. It also provides them the luxury of lower interest rates.

- Improved Assessment Accuracy

Earlier, we noted that alternative credit scoring uses social and digital data to determine whether applicants are creditworthy. This advantage is that a dubious client cannot rely on impressive history to gain loans when they are currently not creditworthy. Also, credible borrowers can access loans and reasonable interest rates based on data that reflect their current state of ability, stability, and willingness to pay.

- Better Opportunities For Borrowers With Limited Credit History

The traditional approach rates borrowers with little credit history as risky. For that reason, even when financial institutions grant them loans, they do so at high-interest rates. Fortunately, the emergence of alternative credit scoring software serves as a reprieve from the burden.

Ready To Leverage Innovative Credit Scoring Software?

Boston Unisoft is one of the formidable thought leaders in the USA fintech industry. We can help you develop smart credit scoring software that embodies the benefits above. Ready to assess loan applications and determine creditworthiness based on borrowers' real-time data? Book a session now to discuss with our expert developers.